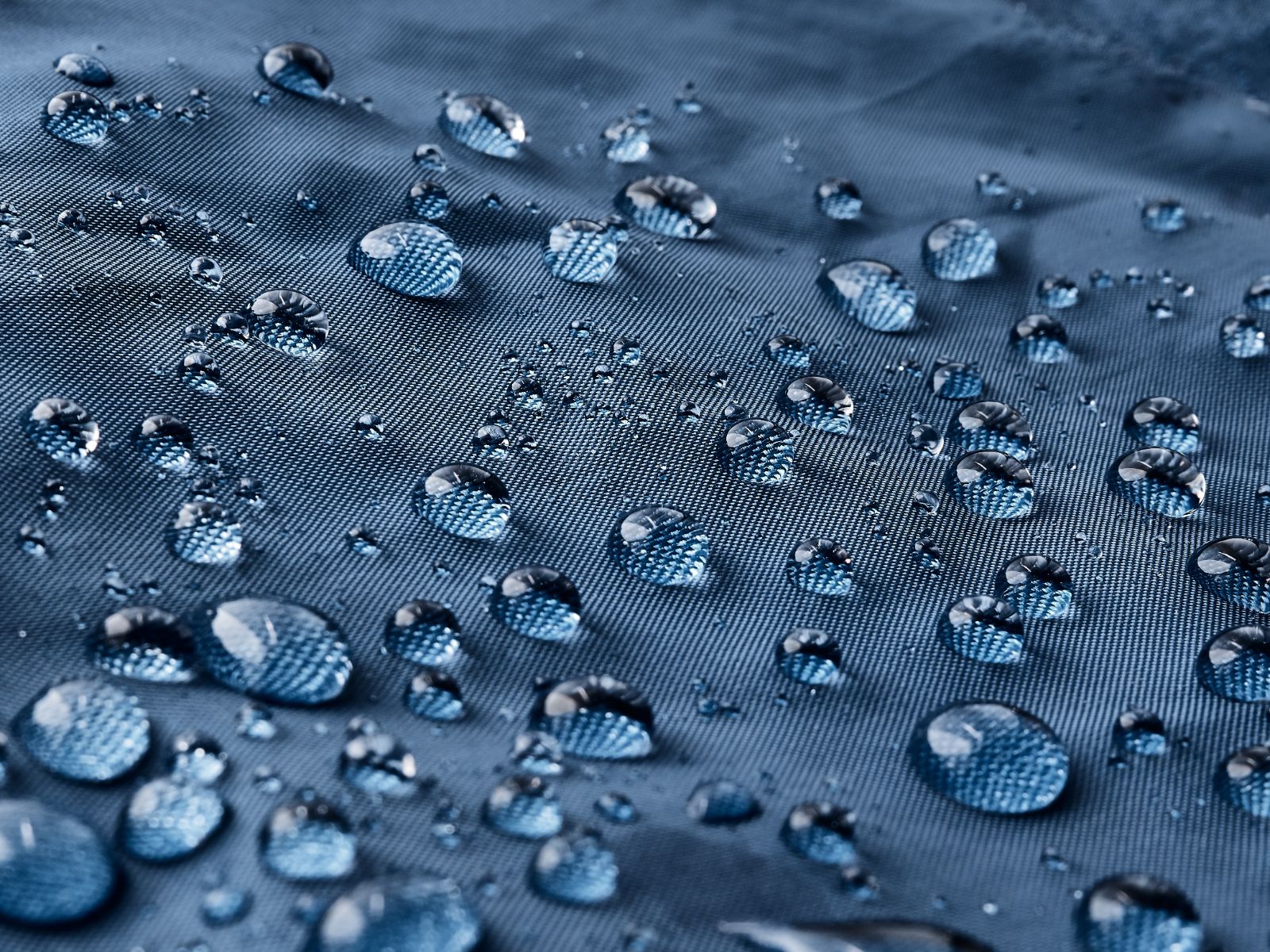

Waterproofing

Waterproofing is a specialised business providing an essential service to residential and commercial clients and dealing with numerous risks on the way. Getting hold of a Waterproofing Insurance Policy will seem like a great investment if you face unforeseen circumstances like a lawsuit for your professional services.

Waterproofing is a specialised business providing an essential service to residential and commercial clients and dealing with numerous risks on the way. Getting hold of a Waterproofing Insurance Policy will seem like a great investment if you face unforeseen circumstances like a lawsuit for your professional services.

Coverage provided

General liability insurance

This provides excellent coverage against claims of injury or damage to the client’s property. It also offers legal costs and court fees etc.

Another aspect of having Waterproofing Liability Insurance is that you can apply for major public contracts requiring such insurance for a qualification.

Professional liability

Professional liability provides cover for claims of professional negligence, human errors, or professional mistakes while conducting your business which can turn into a dragged court case.

Even if you won the case, you’d still have to bear the legal costs and a dent in your professional repute. Waterproofing insurance can come in handy with its professional liability cover.

Equipment & Tools Insurance

You deal with tools and specialised equipment in the waterproofing business, which costs a fortune. With several tools at your disposal, you risk theft or damage to your pricey assets. Waterproofing insurance also covers your tools and equipment in case they are lost, stolen or damaged.